If you are running a business take control of your company’s finances. It is time to stop thinking only your accountant needs to understand your business finances. You need to understand them and be able to talk about them with ease.

If you don’t understand your books or what your accountant does, learn.

I speak with dozens of business owners each day. More often than not, the conversation turns to their businesses and the financial condition of their businesses. All too often, the business owners say they don’t really know their business’ financial condition. When I ask them about profit and loss statements, balance sheets and cash flow they respond as if I am speaking a foreign language of some kind. It is not a good thing.

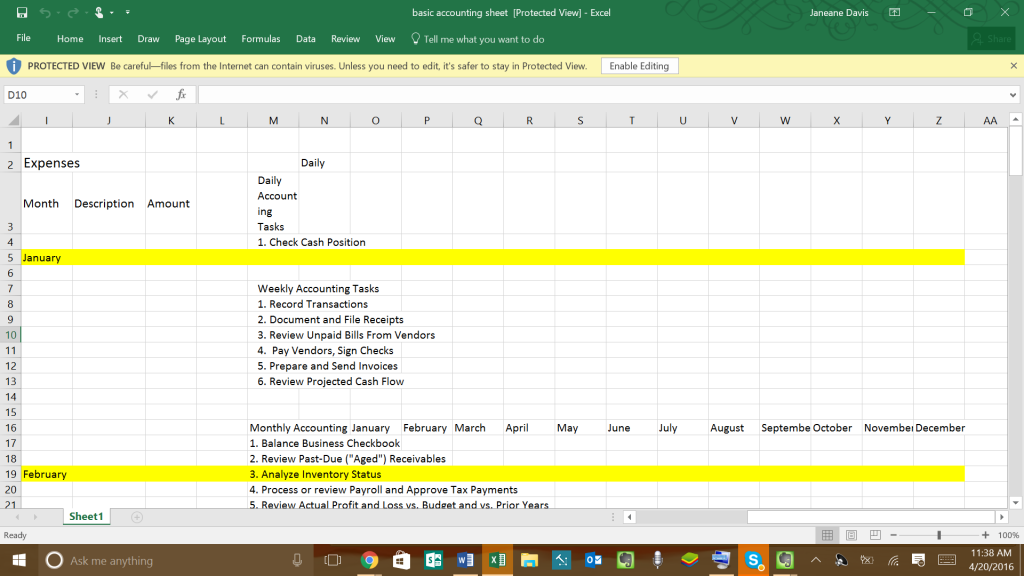

If you are a business owner who does not understand how your business’ books should be kept and what GAArP, A/R and A/P are, it is time for you to learn some basic accounting. No matter what kind of business you have, you must learn basic accounting. When you know and understand basic accounting you are better able to make decisions concerning your business. When you know what the financial condition of your business is, you are in a better position to accept or turn down clients, make the best plans for expansion and conduct day-to-day operations.

There are lots of ways you can learn the basic accounting you need to better operate your business. These methods include the following:

- read a book

- take a course

- talk to an accountant

Read a book

Of course everything you want to know about almost everything in the world can be found in a book. Stop by your local library, bookstore or even browse online. Find a book that is at your level of expertise and work from there. Remember, your goal is not to become a CPA, your goal is to learn enough to be able to operate your business and speak intelligently about your business finances.

[Tweet “If you want your business to take care of you, learn to take care of your business’ accounting records.”]

Take a course

If you are a person who needs help to learn, a course may be the best idea for you. Pick the course type that will fit into your schedule best and start learning. There are a variety of ways you can take an accounting for business course including the following:

- local community college

- college course

- extension program

- open-courseware

- webinar

- e-course

Continued on page 2. Click 2 below to continue.

These tips are perfect to start the month of April, which is Financial Literacy Month. I strongly agree that giving your finances a good spring cleaning checkup is recommended to make sure that you are right on track with your financial planning. I’m guilty of just letting my income-generating investments run on auto-pilot thinking that they will eventually generate money. It’s better to be more hands-on and see what investments are not working well and might as well put it somewhere else that would boost my retirement funds. Likewise in insurance products like life insurance or long term care insurance, it’s best to review your policies to make sure that they will meet your current needs and you can make the most of your policies. For more information about your business strategies click here

I check in with my wife on how our monthly expenses are going and if their are any accounts we should open to take advantage of any perks. It could be a savings account or credit card that will benefit us. I make it a point to go over everything financial wise with her and see what we could improve on

Keeping secret account(s) from your spouse seems unfathomable to me. It creates a lack of communication between the two and may also create a lack of trust in some way. The same goes with not having to know how much salary the other makes.Consultant